Did you know that you can take control of your IRA, 401(k), or other retirement accounts to purchase Costa Rica real estate? If not, you know now!

It is a truth universally acknowledged that a traveler in Costa Rica will likely be in want of a home in Costa Rica… or something like that! (Forgive us the liberties, Jane Austen!) All literary riffs aside, it’s often true: When you travel to a place as beautiful as Costa Rica, you may find yourself imagining an eventual life in this beautiful place.

And if that’s the case, then here’s the good news: If you can afford retirement, you can afford retirement in paradise. All you’ll need is a cooperative retirement fund or IRA custodian, a good real Costa Rica real estate attorney, and a solid investment property.

But before we get into the how of it, let’s talk why:

Why Use Your Retirement Fund to Purchase Real Estate?

The better question might be, why not?

According to Investopedia (and many other sources, search for yourself!), real estate is an excellent alternative to the more traditional stocks, because real estate offers lower risk while diversifying your portfolio and yielding better returns.

Additionally, real estate is a tangible asset. (Depending on your risk tolerance, that can be very appealing.) Of course, as a tangible asset, it’s also more money to break in: You can’t throw a spare $100 at real estate, although you can add it to your retirement fund. And therein lies your why…

Chances are, you’ve been slowly adding to your retirement fund over the years. And so, while you may not have the spare savings to purchase Costa Rica real estate, a healthy retirement fund can fund the purchase of a business or home in paradise.

And that’s the crux of it: Most investors go this route to purchase real estate at today’s prices, even if they don’t plan on moving for years. The huge benefit is that you can earn tax-free income off your investment until you’re 59 1/2 and/or ready to retire, and then you can essentially cash out (= distribute) your IRA and enjoy your real estate purchase for personal use.

One Reason Not to Purchase Real Estate with Your Retirement Fund

We’re not investment professionals, so we cannot speak to recommended alternative investments, legalities, etc., but we can highlight one major reason not to purchase Costa Rica real estate via a self-directed IRA.

Because of the rules and regulations (see more, below) governing retirement investments, you will not be permitted to stay in your investment real estate. This means that you cannot invest your retirement funds into purchasing a property you’ll use today (even if just for a week per year).

How to Use Your 401(k) or IRA to Purchase Costa Rica Real Estate:

While many people don’t realize that you can, indeed, use your retirement fund, including a 401(k) or IRA, to purchase real estate in Costa Rica, it’s not only very possible (and legal) but also a fairly straightforward process.

Here’s how:

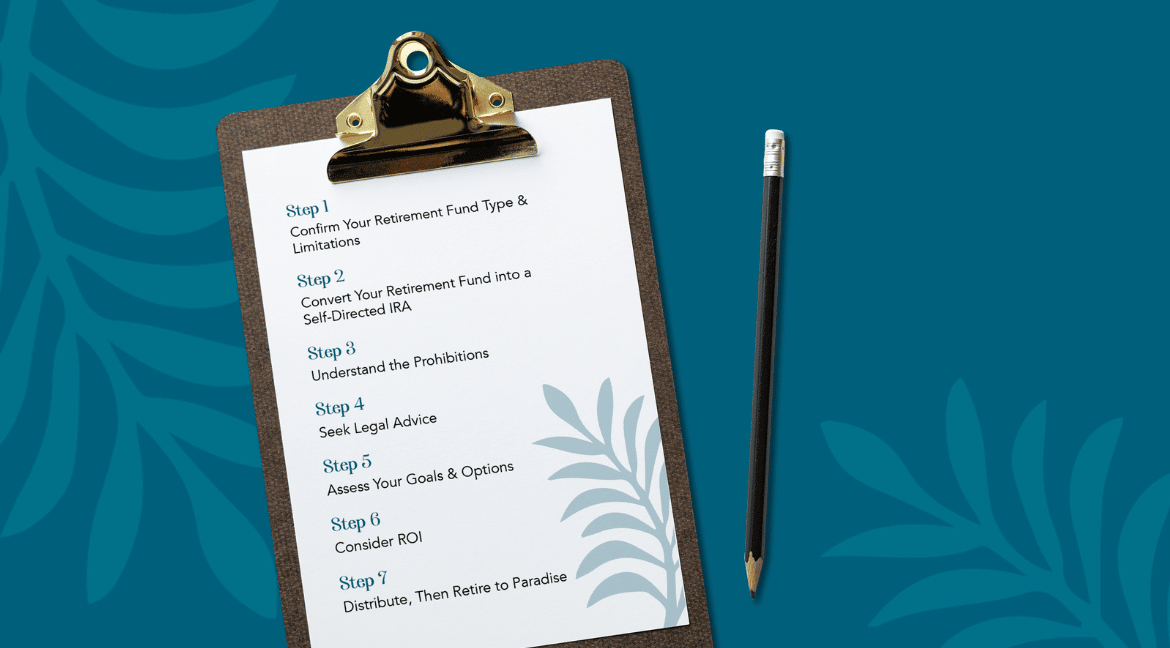

Step 1: Confirm Your Retirement Fund Type & Limitations

Own a retirement fund but didn’t know you could purchase Costa Rica real estate with your savings? You’re not alone.

IRS rules allow you to legally purchase property in Costa Rica with your IRA or 401(k) – without having to pay taxes on those funds. That said, your IRA trustee is not required to offer real estate as one of your IRA investment options. And in fact, many don’t; there’s a lot of extra work and administrative burden associated with managing an investment property over managing, say, stock investments.

So, the very first step is to look into what type of fund you have and whether your fund manager or retirement custodian offers real estate investment options. Chances are, they don’t. In which case, you’ll want to convert your traditional IRA to a self-directed IRA. Which brings us to…

Step 2: Convert Your Retirement Fund into a Self-Directed IRA

You can convert almost any retirement fund – a Simple IRA, Traditional IRA, SEP, Roth IRA, Solo 401(k), etc. – into a self-directed IRA or IRA LLC.

We’ll always advocate that you do your own research, and in this, it is no different. Your retirement funds, your future, your decision. That said, while we’re not attorneys or investment managers, we can say that the basic difference between a traditional IRA and a self-directed IRA is you – you’re in control of a self-directed IRA.

The other big difference is in the nearly unlimited investment options, including in Costa Rica real estate.

Step 3: Understand the Prohibitions

The IRS maintains a list of prohibited transactions for qualified retirement plans and, specifically, for real estate purchases. These include:

- Understand that the term “vacation home” refers to other people’s vacation homes – not your own! In other words, if you invest in a vacation home, it must be one you exclusively rent; you may not stay in it yourself, even if your personal use is for just one week per year. If you use your investment home for your own vacationing, prior to age 59 1/2, then you will incur a 10% early withdrawal penalty and related taxes.

- The biggest prohibition is regarding disqualified persons, who cannot benefit, either directly or indirectly, from your investment property. In layman’s terms, this means that you can’t purchase property you already own, or use your investment as a vacation home, or purchase property from any other disqualified person (e.g. your spouse or immediate family), or any other number of prohibitions.

- Another provision (and prohibition) around disqualified persons regards partnering with others in your investment. In this respect, disqualified persons include a spouse, your ancestors (ex. your parents or grandparents), and your descendants (ex. your children or grandchildren), as well as your IRA advisors, fund trustee, and others.

Step 4: Seek Legal Advice

As you can see above, there are a lot of legalities to a self-directed IRA, so you’ll require some good legal advice. (Get in touch and we’ll be happy to put you in touch with one of our trusted and recommended attorneys.) Here are a few additional things to consider:

Any income from your IRA-owned real estate must return to your IRA. For example, if you were to purchase a home, enroll in the community’s vacation home management program, and earn $XXX/year in rental income, you’d be required to re-invest that income back into your IRA.

Of course, that also means that your retirement savings have an opportunity for healthy fund growth, since your rental income is held within your IRA and is therefore tax-deferred.

That said, we highly recommend discussing all the ins and outs with your trusted investment professional and/or attorney, so you understand the full scope and picture – and so you know what you can and cannot do with your self-directed IRA-owned real estate.

Step 5: Assess Your Goals & Options

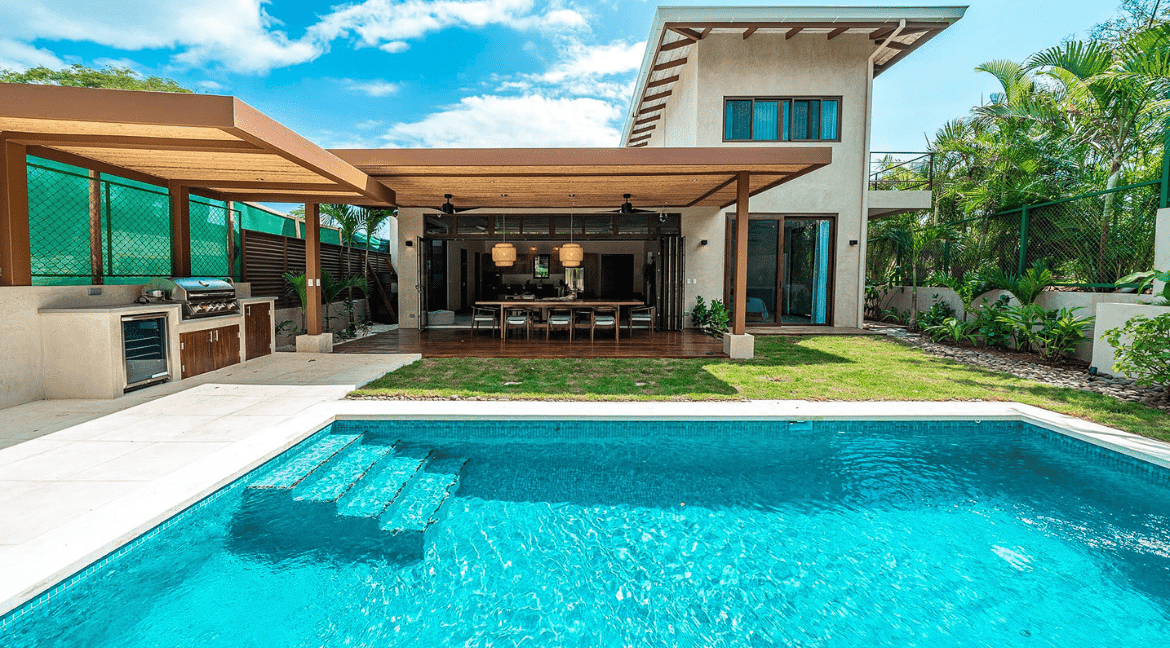

There are many ways to achieve a dream. If you’re an investor – known locally as an inversionista (a route to Costa Rican residency) – said dream hinges on a select inventory of Costa Rica investment properties: the right home, the right restaurant, the right hotel, the right business – that just-right investment to suit your budget, your needs, and your many other requirements.

Before you dive into exploring Costa Rica’s many investment property types and options, think about your end goal. The reason this is so important is that it will inform the types of properties you seek.

For example, if your goal is merely to grow your retirement portfolio via a short-term rental property, then you might prioritize established rentals or communities in high demand. But, if you’re planning to eventually retire in Costa Rica, then you will probably seek a balance between a property’s rental opportunities and your eventual needs.

Step 6: Consider ROI

One of the major benefits of using your 401(k) or IRA to fund your Costa Rica real estate purchase is that your income is tax-exempt because you are required to re-invest back into your IRA.

With that in mind, your self-directed IRA-owned real estate is no longer simply a plan to purchase your future retirement home at today’s market prices; it’s also an excellent investment opportunity.

And with that in mind, at least consider the return on investment (ROI) as you make your decision. While ROI is never guaranteed, Costa Rica’s investment market includes many businesses, including short-term vacation rentals, with proven track records and/or community property management companies, both of which can provide easy property management, peace of mind, and a solid estimate on projected rental income.

Step 7: Distribute, Then Retire to Paradise

In five, ten, or fifteen+ years, when you’re ready to retire, the process is relatively simple (although everything must be done correctly): To convert an investment property into a retirement home, you must first distribute the property. In other words, you must remove the property from the IRA, and transfer it to your name.

To distribute your property, you’ll be required to provide a current, written appraisal showing the market value of the property; your IRA distribution taxes are based on this appraisal. A [major] fringe benefit to this is, if at the time of your IRA distribution, you’ve retired yourself into a lower tax bracket, then you’ll reap serious tax savings.

There’s a lot more detail to the process, but that’s the short of it. And a pretty sweet short it is, which is why so many savvy investors have taken the leap into the so-called “real estate IRA” (officially, a self-directed IRA) and purchased their dream retirement home.

Want to Discuss Costa Rica Investment Properties?

If you’re looking for commercial properties on Guanacaste’s Gold Coast, then welcome to our wheelhouse! From luxury hotels to water sports businesses, from vacation homes to service industry businesses, we broker, offer, and represent a wide range of Costa Rica investment properties for your consideration.

Finding your right fit is not an easy task. At Blue Water Properties of Costa Rica, we’re here to help. To discuss, to advise, and to advocate on your behalf. We’ll send you the properties that fit your budget. We’ll recommend excellent residency and business attorneys. We’ll even put the word out on that uncommon gem you’re after (but that hasn’t yet hit the market).

Along the way, we’ll help you explore all the many possibilities, joys, and roads to life in paradise. That’s what we do. We thrive on relationships. We crave connection. And our goal is never to “sell a business;” it’s to fulfill dreams. It’s to make people happy. It’s to help you. Genuinely help.

We promise the fastest communication and best services in the industry. We will work to deliver on your dream. We will never pressure you. And we really do hope we’ll become friends along the way.

We’re proud to offer some of the best Costa Rica real estate, from condos and homes to land and businesses for sale. So, go ahead – try us. Give us a chance to show off our expertise – and wow you with the possibilities! We look forward to it.